Introduction: Why Volatility Feels Random (But Isn’t)

Many traders experience the same frustration:

- Breakouts fail for no reason

- Price suddenly accelerates with no news

- Markets stall exactly where “they shouldn’t”

This isn’t random behavior.

In most cases, it’s driven by dealer hedging pressure—specifically Gamma Exposure (GEX).

Gamma Exposure doesn’t predict direction.

It explains why price behaves the way it does.

This guide is designed to help you understand GEX in under 5 minutes, without math, jargon, or complexity—so you can:

- Identify volatility fault lines

- Know when markets are likely to range, pin, or explode

- Avoid trading against invisible structural forces

1. Gamma Exposure Explained for Humans

Gamma Exposure (GEX) measures how sensitive options dealers are to price movement.

Dealers don’t speculate.

They hedge risk.

When price moves, dealers are forced to:

- Buy or sell the underlying asset

- Adjust hedges continuously

- Influence volatility as a side effect

Key insight:

👉 Price movement is often a reaction to dealer risk—not trader emotion.

2. Positive vs. Negative Gamma (The Core Concept)

🟢 Positive Gamma: Volatility Is Suppressed

Dealers hedge against price movement:

- Price up → dealers sell

- Price down → dealers buy

Market behavior:

- Choppy, range-bound action

- Failed breakouts

- Strong mean reversion

Best trader mindset:

- Fade extremes

- Take profits quickly

- Avoid chasing momentum

🔴 Negative Gamma: Volatility Is Amplified

Dealers hedge with price movement:

- Price up → dealers buy more

- Price down → dealers sell more

Market behavior:

- Fast directional moves

- Stop runs

- Trend acceleration

Best trader mindset:

- Trade momentum

- Let winners run

- Avoid fading strength

3. The Gamma Flip: The Market’s Hidden Switch

The Gamma Flip is the price level where dealer positioning changes regime.

- Above the flip → typically positive gamma

- Below the flip → typically negative gamma

This level acts as:

- A volatility border

- A regime change trigger

- A structural inflection point

When price crosses the Gamma Flip and holds, the character of the market often changes rapidly.

👉 This is why markets can feel “different” above or below a single level.

4. Volatility Fault Lines: Where Markets Break Easily

A volatility fault line forms where:

- Large options open interest is concentrated

- Dealer gamma changes sharply

- Hedging flows stack in one direction

Common fault-line zones include:

- At-the-money strikes

- Large call or put walls

- Prior settlement or expiration levels

When price enters these zones:

- Small moves can trigger large reactions

- Liquidity thins suddenly

- Price accelerates faster than indicators suggest

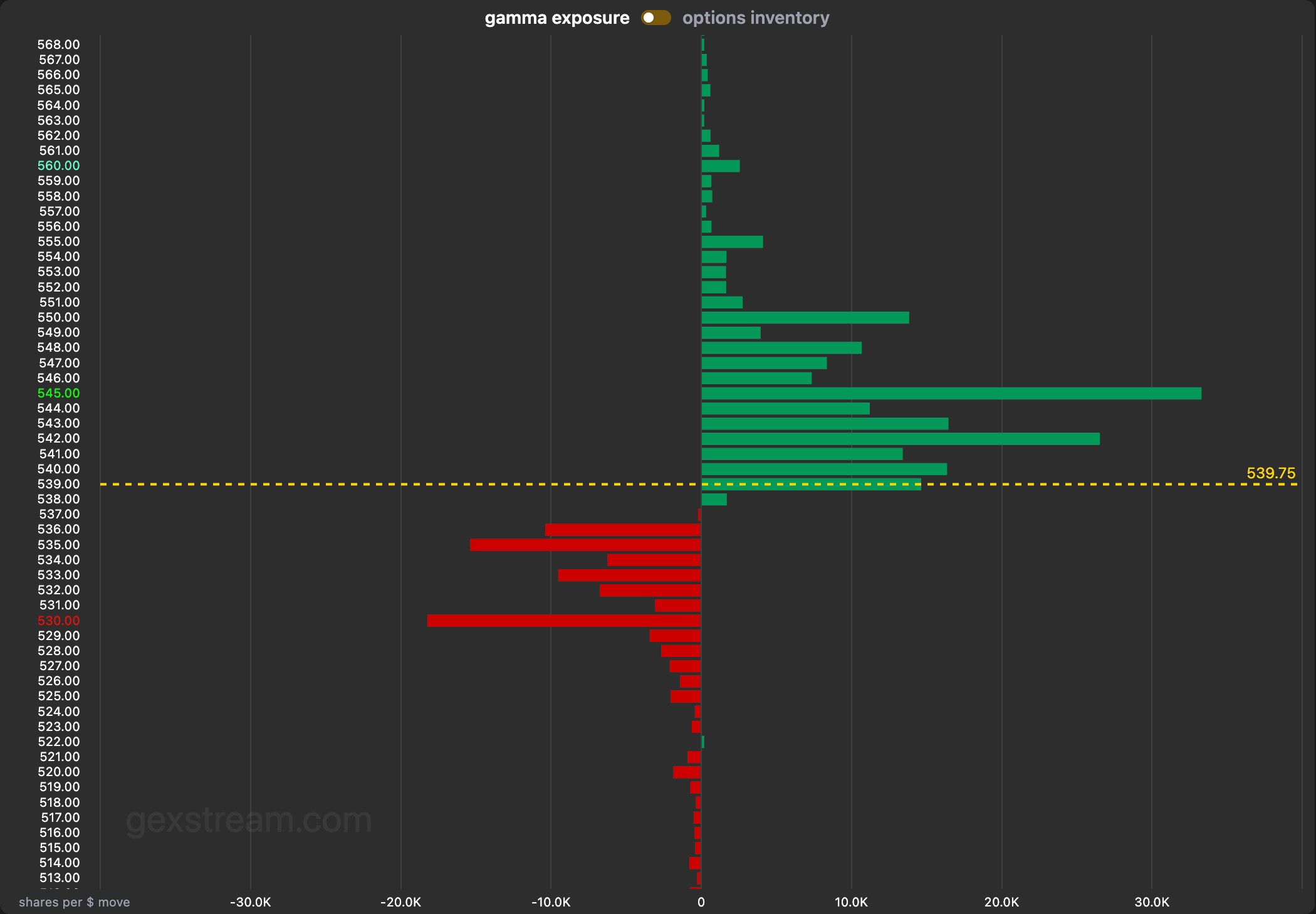

5. How to Read a GEX Dashboard in One Minute

Ignore the noise. Focus on four elements only:

1️⃣ Zero Gamma (Gamma Flip)

The most important level. Market behavior often changes here.

2️⃣ Call Walls

Upper zones where upside may stall—or explode if broken.

3️⃣ Put Walls

Downside stabilization areas or breakdown accelerators.

4️⃣ Net Gamma Bias

- Net positive → range and chop

- Net negative → expansion and momentum

You don’t need precision. You need context.

6. A Simple, Beginner-Safe GEX Trading Framework

Step 1: Pre-Market (5 Minutes)

- Mark Gamma Flip

- Identify largest call and put walls

- Note net gamma direction

Step 2: Match Strategy to Gamma Environment

📉 Price Below Gamma Flip (Negative Gamma)

- Expect momentum

- Favor breakouts

- Reduce counter-trend trades

- Use smaller size with wider stops

📊 Price Above Gamma Flip (Positive Gamma)

- Expect mean reversion

- Fade extremes

- Take profits faster

- Avoid chasing breakouts

Golden Rule

Never trade against the gamma regime.

That’s how traders get chopped or steamrolled.

7. Why Gamma Matters Most Near Expiration (Critical Addition)

Gamma effects intensify as options approach expiration, especially on:

- Weekly options

- Index options

- 0DTE trading sessions

Why this happens:

- Dealer hedging becomes more aggressive

- Small price changes require rapid adjustments

- Markets either pin tightly or move violently

Trader takeaway:

On expiration days, gamma levels often matter more than indicators.

This explains:

- Sudden pinning near strikes

- Late-day volatility spikes

- Sharp reversals with no news

8. When NOT to Trade Using Gamma (Often Overlooked)

Avoid trades when:

- Price is pinned exactly at a large strike

- Net gamma is strongly positive and volume is low

- Price oscillates tightly around the Gamma Flip

- Major macro events are minutes away

Sometimes the best edge is standing aside.

Gamma doesn’t demand activity—it provides awareness.

9. How to Combine GEX With Indicators (The Right Way)

Gamma Exposure works best as a market context tool, combined with:

- VWAP

- Volume profile

- Market structure

- Short-term momentum signals

Think of it this way:

- GEX tells you the environment

- Indicators tell you the timing

Using indicators without gamma context is like driving fast without knowing the road conditions.

10. Common GEX Mistakes Traders Make

❌ Treating gamma levels as exact support/resistance

❌ Ignoring expiration effects

❌ Forcing trades in pinned markets

❌ Using GEX alone without price confirmation

Gamma explains why.

Price still decides when.

Conclusion: Trade the Market You’re In

Most traders lose not because of bad strategies—but because they use the wrong strategy for the environment.

Gamma Exposure helps you:

- Recognize when volatility is likely to compress or expand

- Avoid fighting dealer flows

- Trade with structural awareness instead of emotion

You don’t need prediction.

You don’t need speed.

You need context.

And gamma provides it.