Sage Stash

-

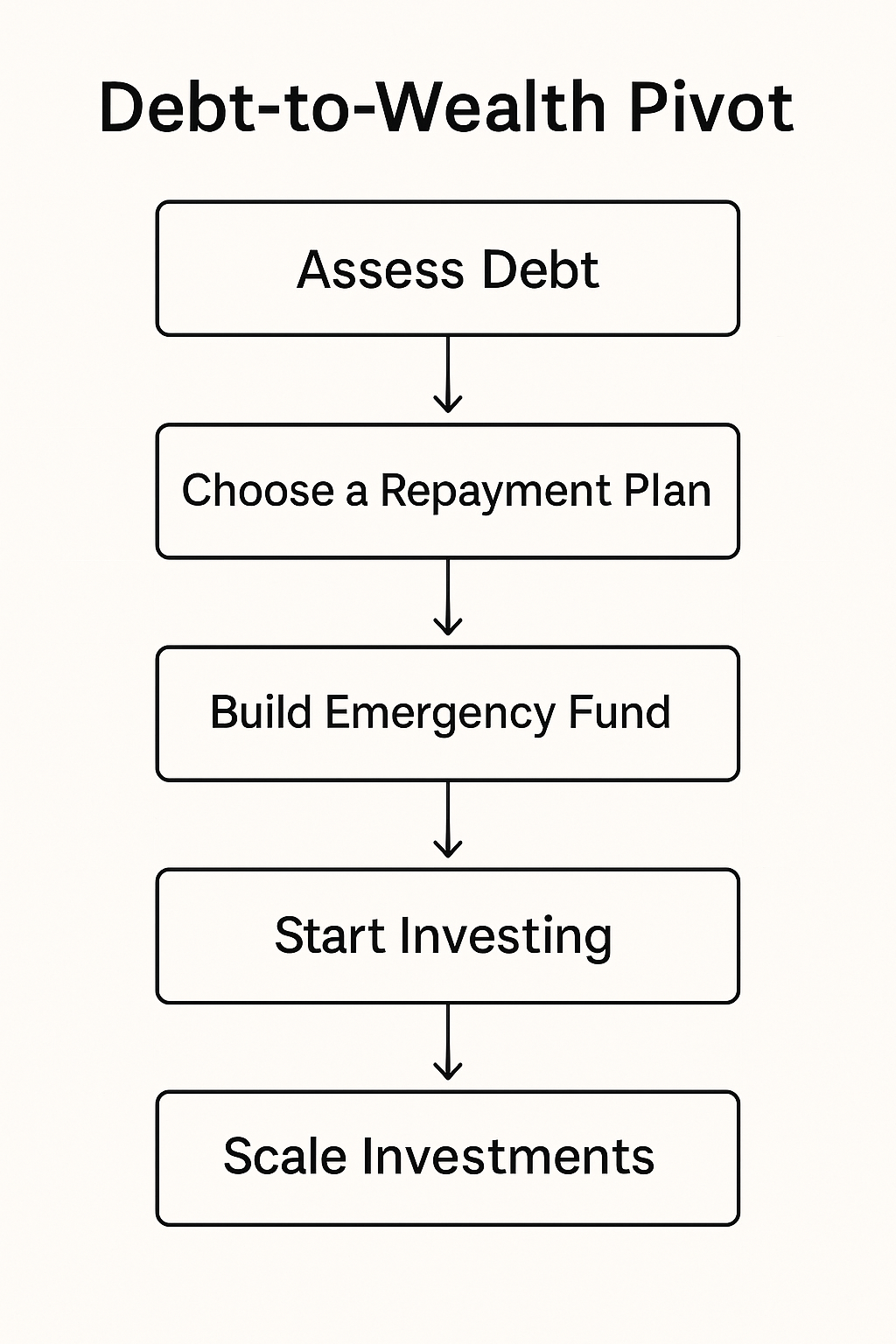

The Debt-to-Wealth Pivot: Turn $10K Debt into a $10K Portfolio

For many millennials and Gen X individuals, the dream of financial freedom feels distant when debt looms large. However, it is entirely possible to transform a $10,000 debt into a $10,000 investment portfolio with strategic planning and disciplined action. This article walks you through a clear, actionable process to pivot from debt to wealth, step… Read more

-

The 30-Day $1,000 Savings Sprint: A Challenge for Every Budget

Saving money can seem daunting, especially when your income feels stretched or your expenses are unpredictable. Yet, the “30-Day $1,000 Savings Sprint” provides a realistic, adaptable, and even fun way to fast-track your savings goals. No matter your financial situation, this challenge offers simple, actionable strategies to help you save $1,000 in just one month Read more

-

The 2025 Recession-Proof Portfolio: 5 Investments to Thrive in Economic Uncertainty

Economic uncertainty can send even seasoned investors into a spiral of anxiety, but history has shown that strategic investments during recessions can not only safeguard wealth but also pave the way for long-term growth. As fears of a 2025 recession loom, the time is ripe to recalibrate your portfolio to withstand economic turbulence. Here, we… Read more

-

Emergency Savings & Financial Resilience: Building Stability in Times of Crisis

Financial stability is not merely a privilege; it is a necessity that provides peace of mind and the ability to navigate life’s inevitable uncertainties. One of the cornerstones of financial stability is having an emergency savings fund. Read more

-

The 2025 FIRE Blueprint: How to Achieve Financial Independence in a High-Inflation World

Achieving Financial Independence and retiring early (FIRE) has always been an ambitious yet achievable goal. However, 2025 brings unique challenges, including high inflation, fluctuating markets, and rising living costs. Read more

-

Mastering the 50/30/20 Rule: Budgeting for Essentials, Savings, and Discretionary Spending

Effective budgeting is the cornerstone of financial health. Among various strategies, the 50/30/20 rule stands out for its simplicity and adaptability. Read more

-

How to Create a Budget That Actually Works: Step-by-Step Guide for Beginners

Budgeting is an essential skill that provides clarity on where your money is going and helps you achieve financial stability. Yet, many people struggle to create a budget that they can stick to. If you’re a beginner, this step-by-step guide will help you craft a realistic and effective budget that works for your lifestyle. Read more