Sage Stash

-

Can AI Outperform Human Investors? An Experiment Revealed

This article explores AI investing’s advantages and pitfalls compared to human strategies, proposing an experimental comparison between AI-driven and human-managed portfolios. It highlights AI’s strengths in data processing and speed while acknowledging human expertise in context and intuition. Ultimately, a hybrid approach that blends both may yield the best investment outcomes. Read more

-

Fractional Real Estate Investing: Owning Property Without a Mortgage

Fractional real estate investing allows investors to own shares in properties or funds without needing full ownership, mortgages, or landlord responsibilities. This approach has gained popularity due to lower minimum investments, improved liquidity, and the rise of tokenization. However, risks include liquidity delays, market concentration, and tax complexities. Investors should prioritize due diligence, diversify their… Read more

-

Recession-Proof in 2025: 5 Money Moves to Make Right Now

The 2025 economy presents challenges with cooling inflation and a softening job market. To navigate this, households are encouraged to enhance financial resilience through five actionable strategies. These include upgrading cash strategies for higher returns, minimizing high-interest debt, establishing secondary income streams, adjusting investment portfolios for stability, and cutting fixed costs. Implementing these practical steps… Read more

-

FinTok Trends That Actually Work: Side Hustles, Passive Income & Crypto

FinTok—the finance corner of TikTok—has matured from quick “money hacks” into a crowded marketplace of ideas where a few strategies consistently produce measurable results while most trends fizzle. This article focuses on what actually works in 2025, using specific numbers, replicable playbooks, and risk controls. You’ll find data-informed examples, step-by-step systems you can execute this… Read more

-

How $6 a Day Could Make You a Millionaire

Investing just $6 a day can lead to over $1 million in 39 to 50 years, depending on the rate of return. Using simple math, consistent low-cost investments, and the power of compounding, even modest daily contributions can yield significant financial outcomes over time. The guide emphasizes starting early, maintaining low fees, and automating contributions.… Read more

-

Crypto in Retirement Accounts: ETH ETF Surge & a 1–5% Sleeve That Behaves

Introduction Ethereum’s spot ETFs have moved from curiosity to core conversation in retirement planning. With billions in fresh inflows and blue-chip issuers behind the products, a disciplined 1–5% “crypto sleeve” can give long-term investors measured exposure—without turning a retirement portfolio into a rollercoaster. The key is engineering the sleeve to behave: use a volatility-triggered rule, Read more

-

Income ETFs Are Booming: Covered-Call vs Buffer ETFs

Income ETFs have exploded in popularity as Gen Z and Millennial investors seek simpler, rules-based ways to earn cash flow without building dividend stock lists from scratch. Two strategies dominate the conversation: covered-call ETFs and buffer/defined-outcome ETFs Read more

-

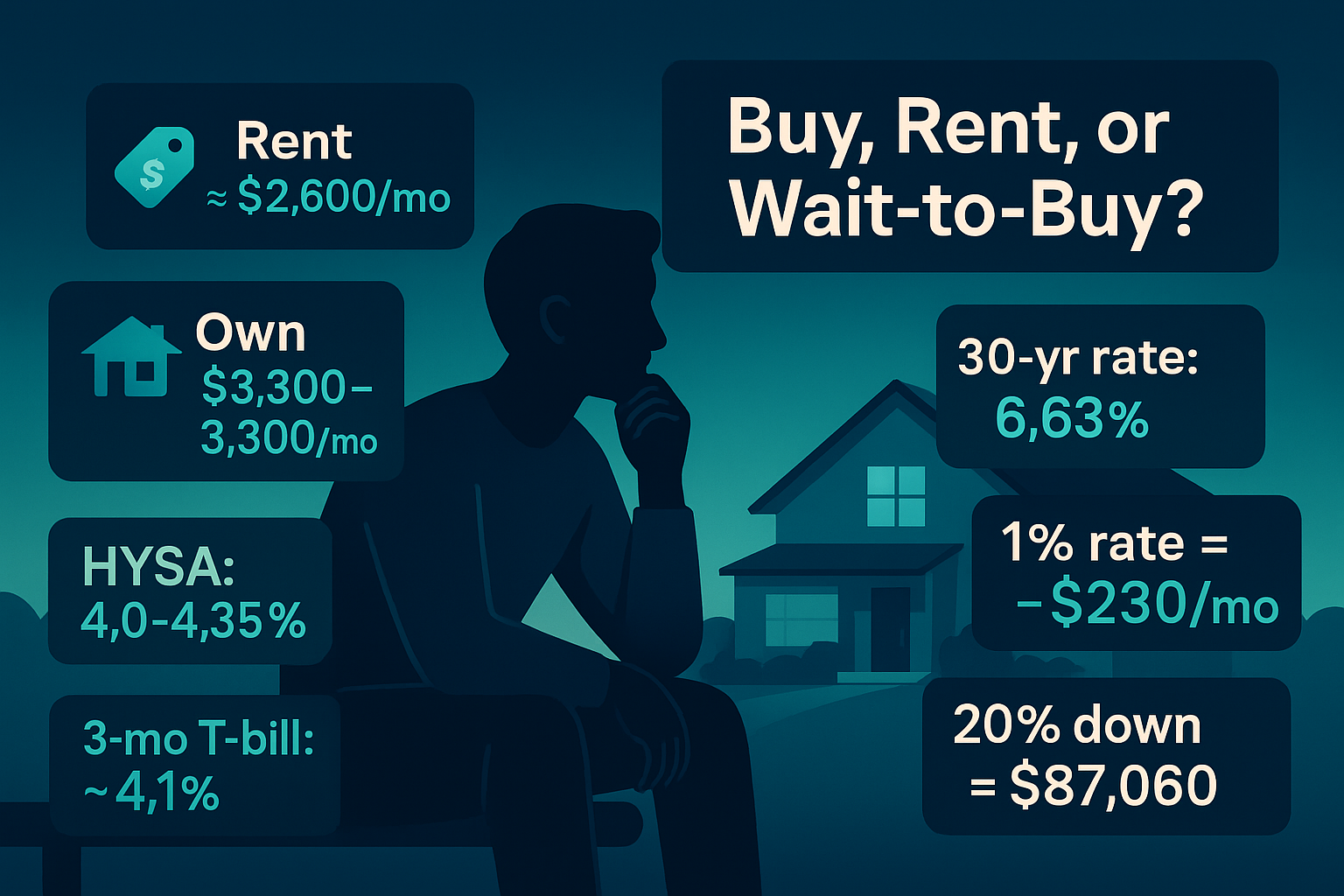

Housing in 2025: Buy, Rent, or “Wait-to-Buy”?

Use 2025 numbers to decide whether to buy, rent, or wait. Break-even math, rate-sensitivity, and a wait-to-buy playbook with HYSA/T-bill yields Read more